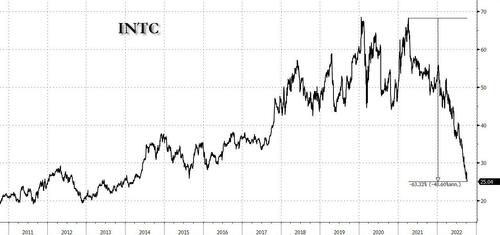

With the personal computer market crashing at an unprecedented pace, and with Intel stock losing two-thirds of its value in the past year and plunging to 10-year lows...

... Intel - which is just days from becoming the target of some activist hedge fund campaign - is planning a "major reduction" in headcount, numbering in the thousands according to Bloomberg, to cut costs and cope with the suddenly disintegrating PC market.

The layoffs will likely be announced around the time the company reports its Q3 earnings on Oct. 27, said Bloomberg sources. And there will be quite a few to pick from: the chipmaker had 113,700 employees as of July, or a roughly 1 worker for every market cap in value (INTC's market cap closed at a 8-year-low of $102.8 billion today). Some divisions, such as Intel’s sales and marketing group, could see cuts affecting about 20% of staff, the report noted.

Besides the dismal macro environment which has crippled demand for PC processors, its main business, Intel has also struggled to win back market share lost to rivals like AMD and Nvidia. In July, the company warned that 2022 sales would be about $11 billion lower than it previously expected. Expect another ugly last-minute preannouncement, or even uglier Q4 and full year guidance. Analysts are predicting a third-quarter revenue drop of nearly 20%; meanwhile Intel’s once-enviable margins have also shriveled: amid the ongoing inventory liquidations and surging commodity prices, they’re about 15 percentage points narrower than historical numbers of around 60%.

During its second-quarter earnings call, Intel acknowledged that it could make changes in its business to improve profits. “We are also lowering core expenses in calendar year 2022 and will look to take additional actions in the second half of the year,” Chief Executive Officer Pat Gelsinger said at the time.

Intel’s last big wave of layoffs occurred in 2016, when it trimmed about 12,000 jobs, or 11% of its total. The company has made smaller cuts since then and shuttered several divisions, including its cellular modem and drone units. Like many companies in the technology industry, Intel also froze hiring earlier this year, when market conditions soured and fears of a recession grew. And now it is moving to the inevitable final stage of rightsizing: mass layoffs.

As Bloomberg notes, "it’s a particularly awkward moment for Intel to be making cutbacks. The company lobbied heavily for a $52 billion chip-stimulus bill this year, vowing to expand its manufacturing in the US. Gelsinger is planning a building boom that includes bringing the world’s biggest chipmaking hub to Ohio."

Well, so much for Biden's stimulus. Oh well, at least it can be redirected to support the pristine, uncorrupted administration in Ukraine.

US tensions with China also have clouded the chip industry’s future. The Biden administration announced new export curbs on Friday, restricting what US technologies companies can sell to the Asian nation.

David Zinsner, Intel’s chief financial officer, said after the company’s latest quarterly report that “there are large opportunities for Intel to improve and deliver maximum output per dollar.” The chipmaker expected to see restructuring charges in the third quarter, he said, signaling that cuts were looming.

What about others? Well, notable chipmaker competitors such as Nvidia and Micron have said they’re steering clear of layoffs for now, but expect that to change very soon. But other tech companies, such as Oracle Corp. and Arm Ltd., have already been cutting jobs.

Of course, none of this will impact the absolute datamockery which the BLS engages in every month and we fully expect the October jobs report, due just days before the midterm election, to show hundreds of thousands of farcically bullshit job gains. And just as predictably, once the midterms are in the rearview mirror and the government can again report the truth, we expect revisions will confirm that the US economy is currently losing several hundred thousand workers every month, a number which will only rise as the Fed triggers the worst global recession since the financial crisis.

via zerohedge